Technical Briefing: Financial Services & Object-Oriented System Design

65% Faster Approval via optimized AI UML Class Diagrams

AI Loan Application Class Modeling

How to structure the data model for 65% faster loan approvals

The Dragon1 AI UML Software Architect Tool modeled the loan domain, defining the classes for automated risk gates, parallel data validation, and real-time credit scoring to reduce decision time from 12 days to 4.

1. Current State (As-Is) - Manual Sequential Model

High Error Rates | Synchronous Data Processing

2. Target State (To-Be) - AI-Driven Parallel Model

4-Day Decision Cycle | Automated Risk Routing

AI-Powered Scenario Modeling & Time-Lapse Visualization

Financial Justification

€2.5M Increase in Annual Loan Volume

65%

Reduction in total approval time (from 12 days to 4 days).

20%

Reduction in manual risk rerouting, focusing underwriters on complex cases.

100%

Compliance and decision traceability for every automated AI gate.

The Enterprise Result: Fintech Transformation

4 Days

Accelerated Time-to-Decision.

By moving to parallel validation classes, we eliminate the sequential bottlenecks that previously stalled applications for weeks.

80%

Automated Pre-Check Rate.

The AI Eligibility class automatically filters standard applications against mandatory lending criteria.

Traceable

Audit-Ready Logic Architecture.

Every decision method and attribute change is documented on each page of the system blueprint for regulatory review.

Logic Comparison: Sequential vs. Parallel Architecture

1. Current State (As-Is): Sequential Data Model

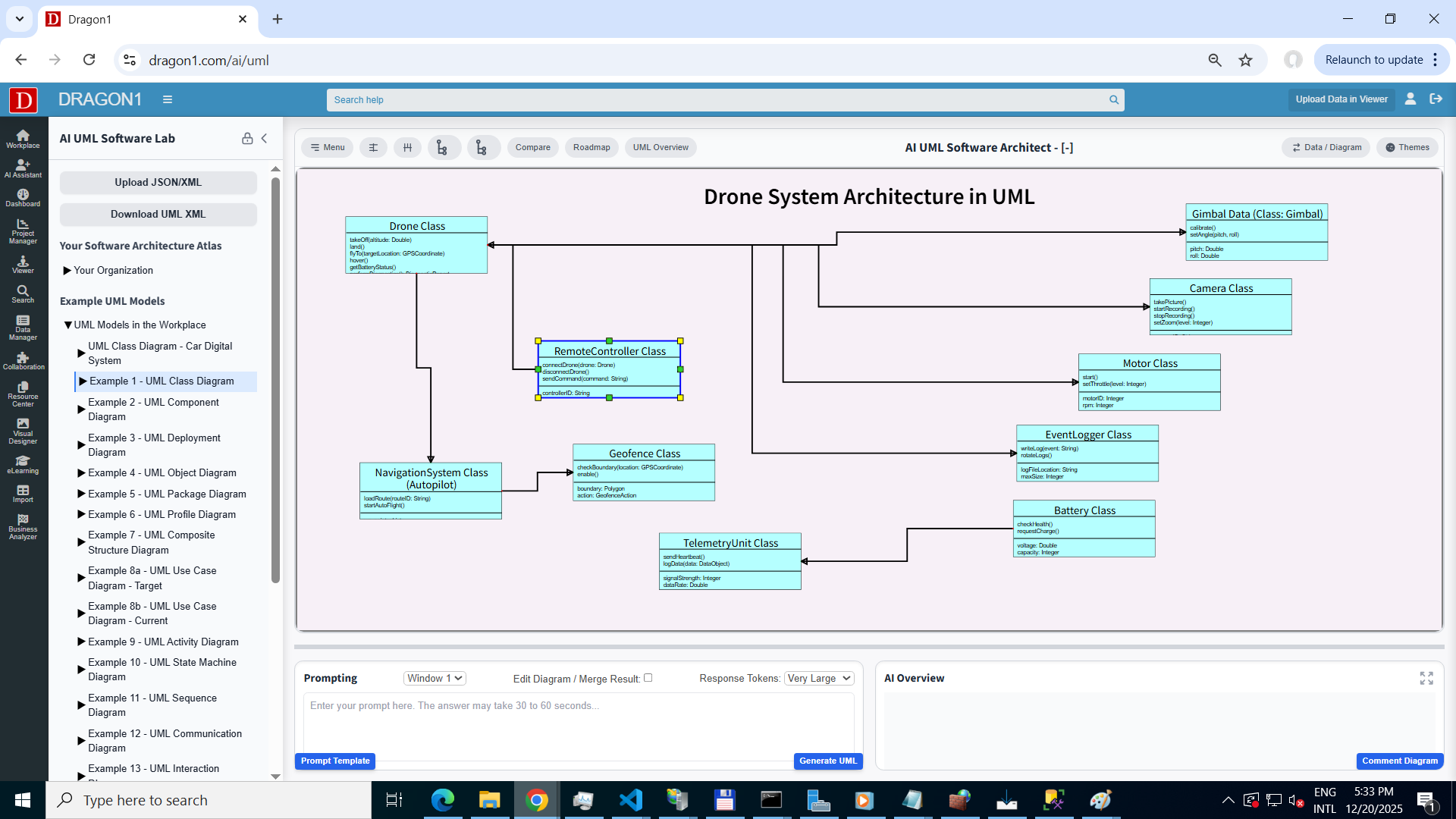

The existing model forces data validation classes to run in a strict sequence, where one failure stalls the entire application object.

| Synchronous Validation | Identity and income verification cannot start until credit checks are finished. | 3-5 Days dead time |

2. Future State (To-Be): Parallel Service Model

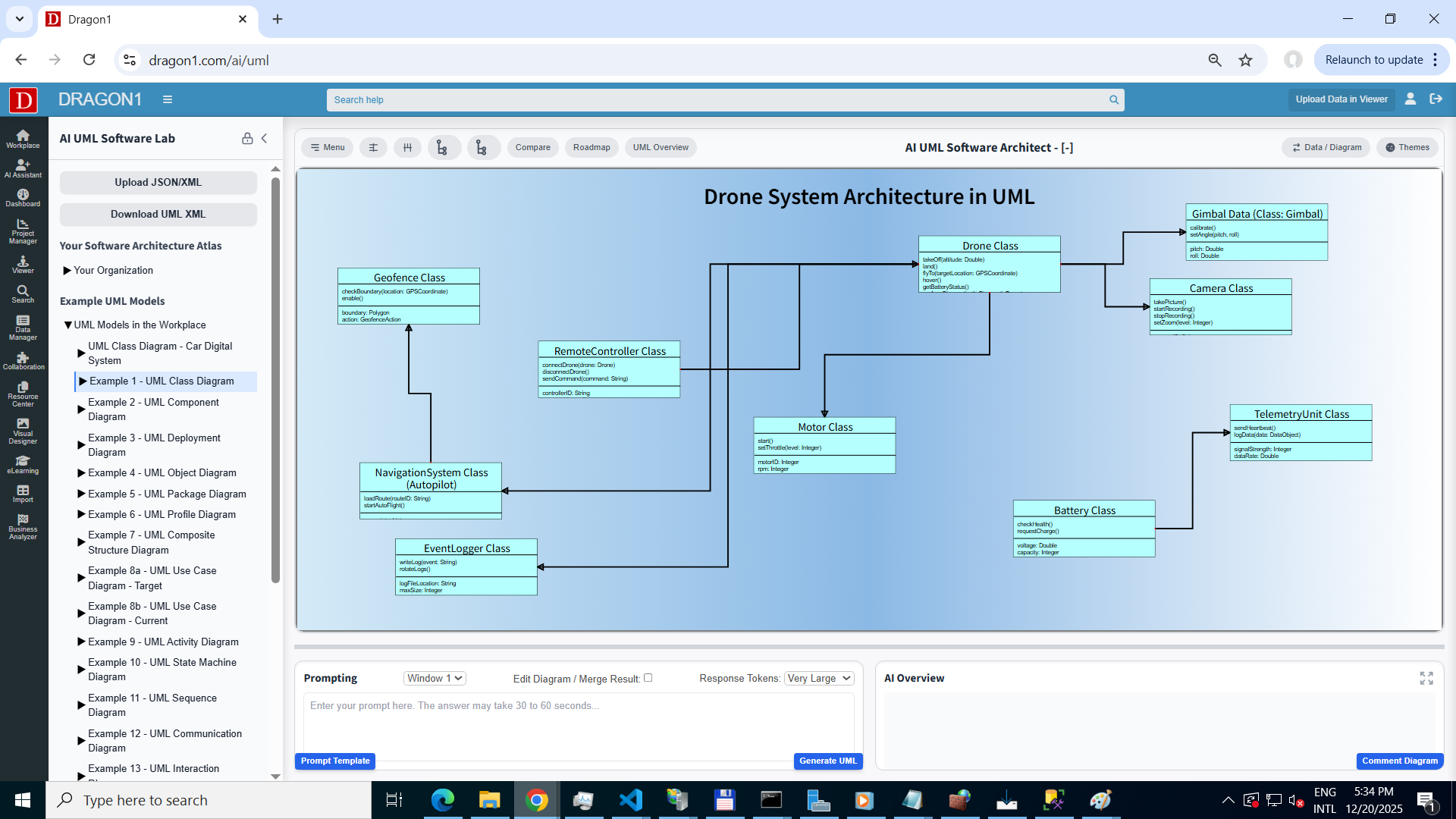

The AI UML Software Architect tool generated an AI-optimized model that utilizes decoupled observer patterns to run Credit, Identity, and Income validation concurrently.

| Concurrent Verification Services | The Loan Application class triggers independent validation tasks for parallel processing. | Total approval time reduced by ~1 week. |