CxO Briefing: Finance Process Optimization

65% Faster Loan Approval via AI BPMN Transformation

Loan Application Processing

How to reduce decision time in loan approval processing?

The Dragon1 AI BPMN Process Architect optimized the loan application process, reducing decision time from 12 days to just 4, significantly improving customer conversion and risk scoring accuracy.

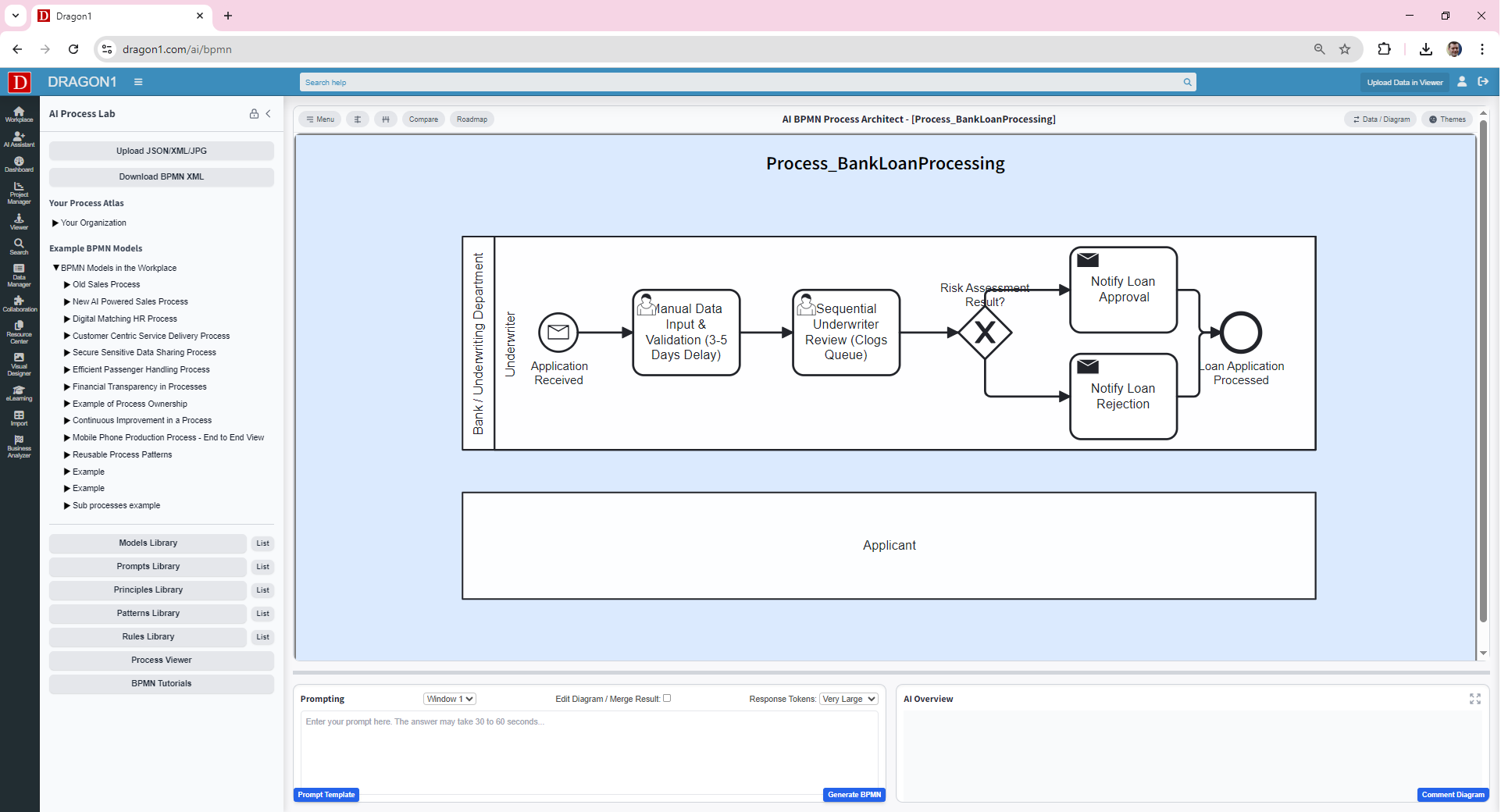

1. Current State (As-Is) - Manual Risk Gate

12 Days to Approval | High Withdrawal Rate

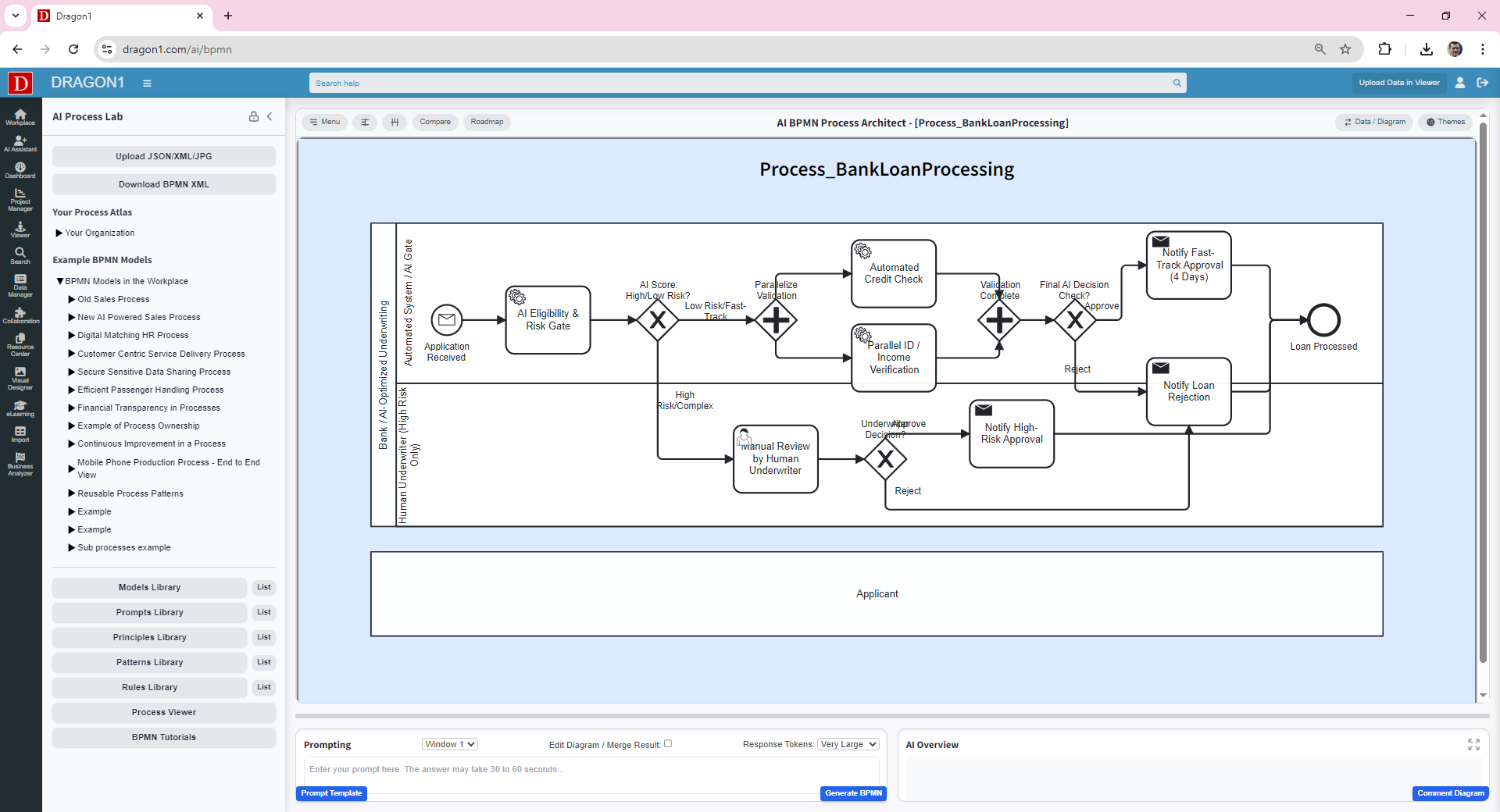

2. Future State (To-Be) - AI Optimized

4 Days to Approval | Automated Eligibility Check

Immediate Payback Justification

85% Modeling Efficiency: The Cost of Doing Nothing

85%

Reduction in time to create and document complex BPMN models.

€2.5M

Estimated annual increase in loan volume due to reduced abandonment rates.

4 Days

New average time for full application review and final decision.

The Enterprise Result: Transformation Metrics

65%

Faster Loan Approval Time (12 days to 4 days).

Directly impacts customer satisfaction and reduces loss of applicants to competitors.

20%

Reduction in Manual Risk Rerouting.

AI pre-filters standard applications, focusing human analysts on high-risk, complex cases only.

Audit Trail

100% Compliance and Decision Traceability.

The documented BPMN model ensures every AI decision gate is auditable, mitigating regulatory compliance risk.

Detailed Process Comparison: Before and After AI

1. Current State (As-Is): The 12-Day Delay

The initial process relied heavily on sequential, manual underwriting and risk review, leading to high processing costs and slow response times, confirming an average Time-to-Approval of 12 days.

| Manual Data Input & Validation | Data was manually entered and cross-referenced with external credit bureaus, causing errors and multiple re-checks. | 3-5 days of initial unpredictable delay; high error risk. |

| Sequential Underwriter Review | Low-risk and high-risk cases were treated equally, clogging the underwriter queue. | Significant downtime accumulated due to uniform processing of all cases. |

2. Future State (To-Be): The 4-Day AI Optimized Blueprint

The Dragon1 AI BPMN Process Architect generated the Future State model, embedding a smart AI decision module to automate screening and parallelize validation, achieving a Time-to-Approval of 4 days (a 65% reduction).

| AI Eligibility & Risk Gate | Automated pre-check against mandatory criteria and immediate routing of standard/low-risk applications for fast-track approval. | 80% faster initial scoring and immediate parallel data validation. |

| Parallelized Data Validation | Credit, identity, and income verification run concurrently, eliminating sequential waiting periods. | Reduced Time-to-Approval by ~1 week by minimizing dead time. |