CxO Briefing: Financial Planning & Analysis

90% Fewer Data Entry Errors via AI-Powered Accounting

Financial Planning and Analysis (FP&A) Process

How to automate invoice recognition?

The Dragon1 AI BPMN Process Architect optimized core FP&A processes, automating invoice recognition and reconciliation, leading to higher forecast accuracy and zero entry errors.

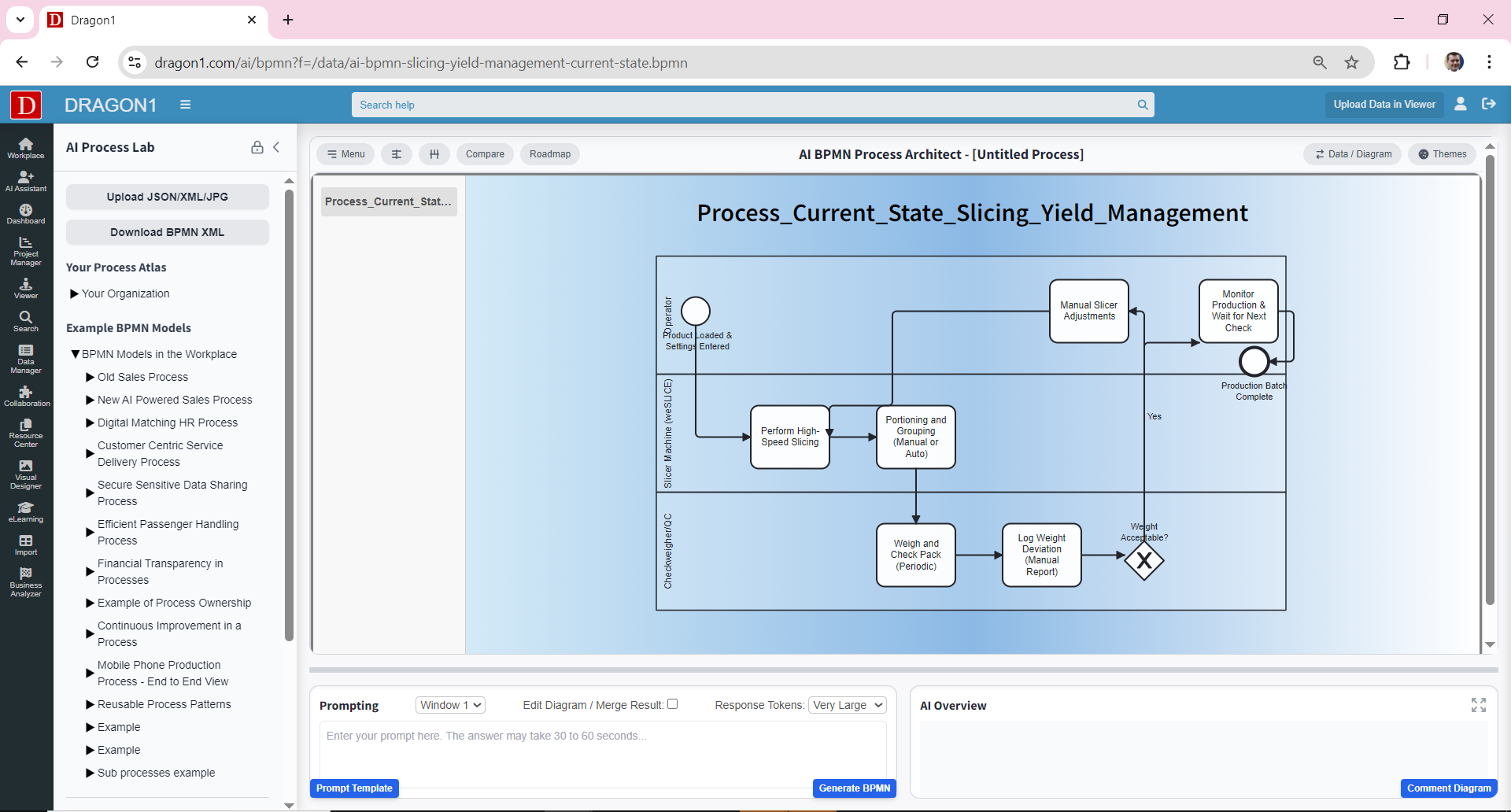

1. Current State (As-Is) - Manual Reconciliation

High Error Rate | Slow Month-End Close

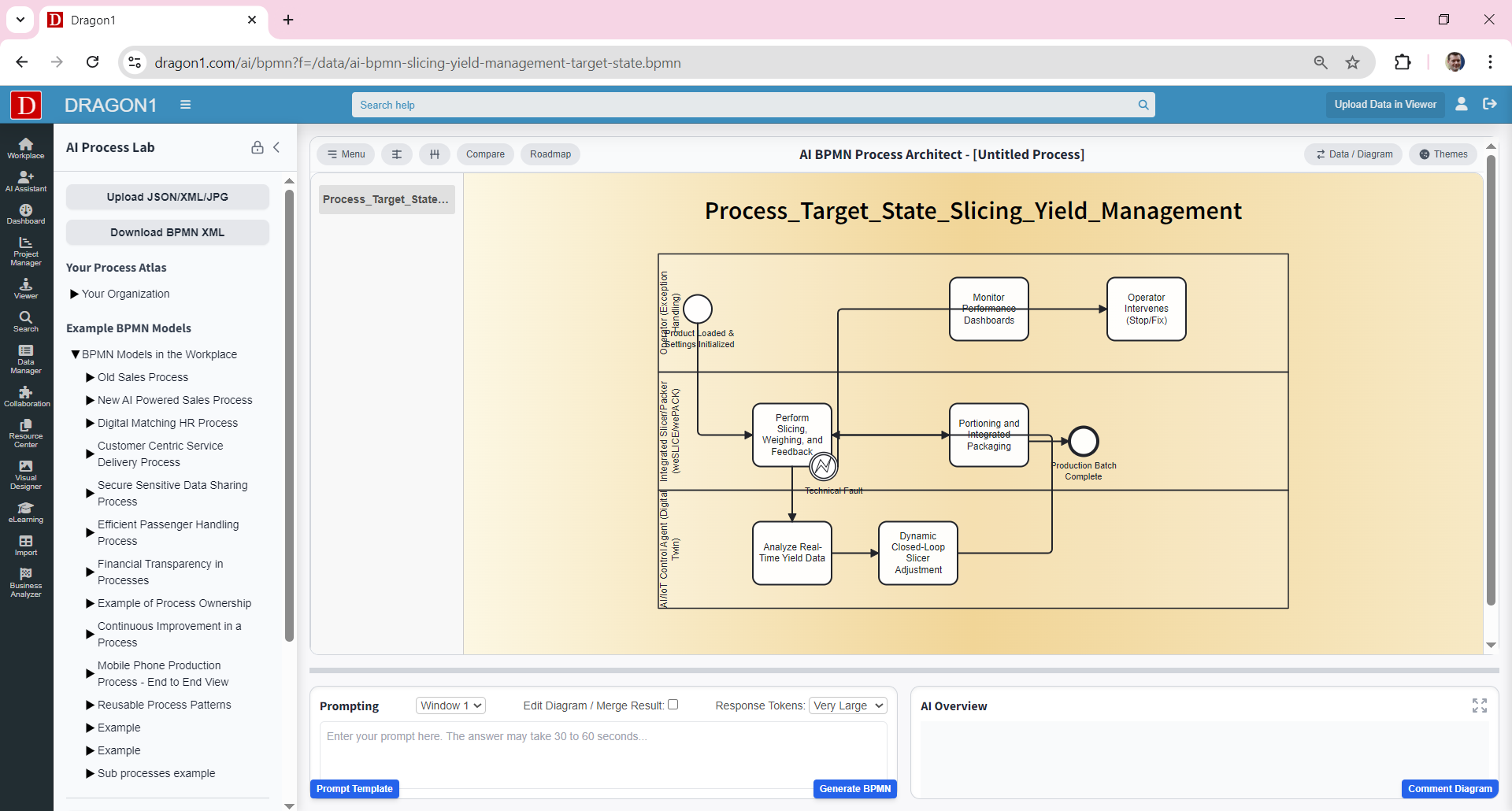

2. Future State (To-Be) - AI Reconciliation & Forecasting

Zero Entry Errors | Real-Time Cash Flow

Immediate Payback Justification

85% Modeling Efficiency: The Cost of Doing Nothing

90%

Reduction in time spent on manual data entry and reconciliation checks.

22%

Improvement in cash flow and inventory forecast accuracy.

3X

Faster detection of potential fraud and financial anomalies.

The Enterprise Result: Transformation Metrics

90%

Reduction in Data Entry Errors.

Directly impacts compliance and the reliability of external financial reporting.

22%

Improved Forecast Accuracy.

ML forecasting allows for proactive strategic decision-making regarding capital allocation.

Zero-Touch

Automated Invoice Processing.

The documented BPMN model ensured AI-driven document recognition integrated correctly into the ERP and approval flows.

Detailed Process Comparison: Before and After AI

1. Current State (As-Is): The Manual Audit Risk

The initial process required heavy manual data input from receipts and invoices, followed by time-consuming reconciliation checks across ledgers.

| Document Data Entry (Invoices/Receipts) | Clerks manually transcribed data from paper and PDF documents into the accounting system. | High risk of transcription errors (up to 5%); significant staff time consumption. |

| Manual Reconciliation & Audit | Analysts spent days at month-end manually comparing ledger entries and finding discrepancies. | Delay of 3-5 days for month-end close; high labor cost. |

2. Future State (To-Be): The 90% Reduced Error Blueprint

The Dragon1 AI BPMN Process Architect generated the Future State model, utilizing AI-driven OCR and ML reconciliation, achieving a 90% reduction in errors.

| AI Document Recognition (OCR) | Invoices are scanned, and AI automatically extracts, verifies, and posts the data to the correct ledger. | Eliminated all manual data entry and associated errors. |

| Continuous ML Reconciliation | Machine learning models continuously monitor ledgers for anomalies and auto-reconcile standard transactions. | Reduced month-end close time by 80% and provided real-time visibility. |