CxO Briefing: Insurance Operations & Risk Management

70% Reduction in Claim Processing Time via AI BPMN Transformation

Automated Claims Adjudication Process

The Dragon1 AI BPMN Process Architect modeled the claims workflow, deploying AI agents to ingest claim data, verify policy coverage, detect fraud, and auto-approve low-complexity claims.

1. Current State (As-Is) - Manual Review & Fraud Sifting

8-10 Day Cycle Time | High Processing Costs

2. Future State (To-Be) - AI Optimized Adjudication

2-3 Day Cycle Time | Automated Approval

Immediate Payback Justification

85% Modeling Efficiency: The Cost of Doing Nothing

85%

Reduction in time to create and document complex BPMN models.

€1.5K

Average cost saved per claim by eliminating manual handling and reducing error rework.

98%

Accuracy in classifying claims as low-complexity for auto-approval without human intervention.

The Enterprise Result: Transformation Metrics

70%

Reduction in Claim Processing Time.

Boosts customer satisfaction (NPS) and frees up adjusters for complex cases.

90%

Faster Fraud Anomaly Detection.

AI uses image and text analysis to flag suspicious claims instantly, minimizing potential payout losses.

Compliance

Standardized and Auditable Decision Making.

AI enforces policy rules consistently, reducing legal risk and ensuring fair outcomes.

Detailed Process Comparison: Before and After AI

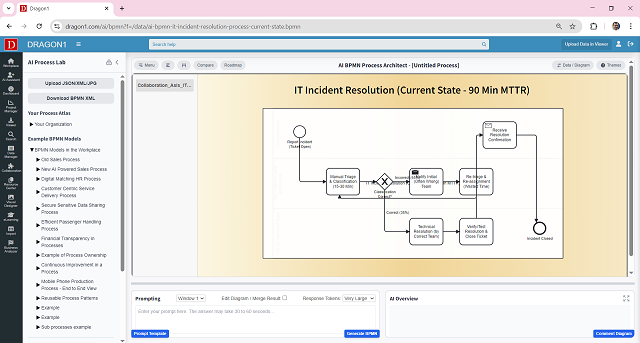

1. Current State (As-Is): The Slow, Costly Hand-Off

The process relied on adjusters manually reviewing forms and damage photos, cross-referencing policy documents, and relying on subjective experience for fraud assessment, leading to long delays and high labor costs.

| Policy and Coverage Verification | Adjusters manually search and confirm policy terms and conditions apply to the specific claim details. | 3-4 days of processing time added due to manual verification and communication lag. |

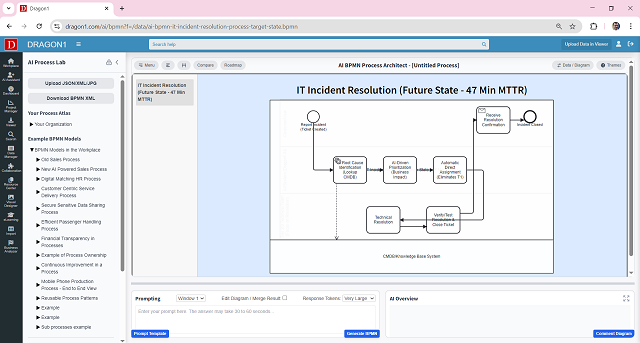

2. Future State (To-Be): The 70% Faster AI Blueprint

The optimized process employs the Dragon1 AI BPMN Process Architect for initial triage, data validation, and automated policy verification. Low-complexity claims are auto-adjudicated immediately, achieving a 70% reduction in cycle time.

| AI Policy & Fraud Check (Real-time) | AI automatically ingests all claim data, checks coverage validity instantaneously, and uses predictive analytics to score the claim for fraud anomalies before any human touches it. | Reduced the total processing time for low-complexity claims from days to hours. |